Launching a standout card program: How travel firms can do it (and why they should)

5 minute read

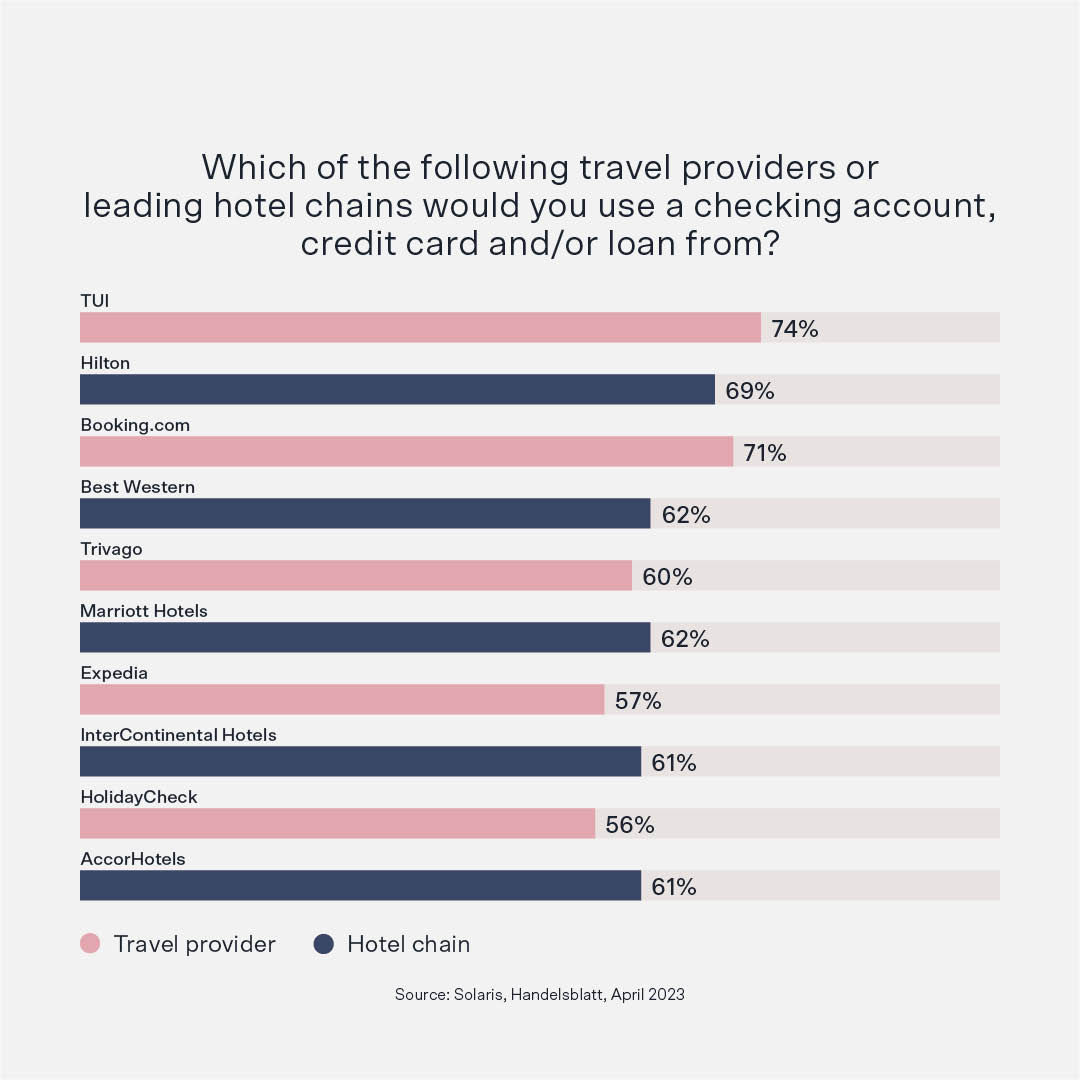

With the tourism and travel industry on the up, and a potentially huge addressable market — our research shows consumers are increasingly open to trying embedded financial services products from trusted travel providers — there's never been a better time to consider launching a card program if you're a travel firm.

But once you've decided to do it, then what? How do you go about setting it up?

Let us walk you through the typical process our partners go through to move from concept to market-ready product reality.

Step 1: Start with why

Before you think about the mechanics of your card program, it's worth making sure you understand your reasons for launching one. Why do it? What are you expecting to get out of it?

Cards generate additional revenue for your business from interchange fees. Even better, they create opportunities for you to deepen your relationships with your customers, boosting loyalty and trust.

Say you're an online booking platform. Your customer — a regular business traveler — uses your services whenever they need to book a business trip. They also book their annual family holiday through your platform.

As things stand, the customer already trusts your brand. That said, your relationship is purely transactional. The customer interacts with your brand when they need to make travel arrangements. But, the rest of the time, you're out of sight and out of mind.

Offering them a branded card changes the dynamic. You no longer sell one specific, time-limited product — travel and accommodation bookings. Now, they're also using your card to pay for their airfare, train tickets, meals and entertainment throughout the trip.

They'll also use your card in other situations as they go about their daily lives: to pay for their morning coffee, for their weekly shop, for a night out with friends, and for other purchases. This means they're interacting with your brand on a regular basis, even when they're not traveling or thinking about travel.

Crucially, the customer's payment data enables you to offer them highly personalized and, so, more valuable rewards.

"Seeing where customers are spending, especially if they're not spending with you, can be very valuable because it shows you what matters to them at a specific time," says Solaris Business Development Manager, Darren Lane.

"This enables you to tweak your loyalty program so you can offer better rewards. Rewards your customers will appreciate all the more because they will make a real difference to them."

This level of hyper-targeting — only possible because of the unique knowledge you possess about the customer — creates a virtuous cycle.

The more a customer uses your branded card, the more rewards they earn. This encourages them to keep using the card. And, more importantly, it increases their satisfaction, trust, and loyalty to your brand.

Step 2: Evaluate your capabilities

Once you know what you want to get out of your card program, it's time to assess the best way to implement it.

A key benefit of embedded finance technology is that it gives you, the brand, complete control of the product, while your third-party provider handles the complexity.

The flip side is that you need to decide what you want that product to look like, including which processes you want to outsource and which you'd prefer to keep in-house.

Some decisions will be obvious.

"As a travel firm, you probably don't have financial services compliance expertise or technical capabilities like card issuing and payment processing," says Solaris Business Development Manager, Russell Sopp. "As a regulated entity with a financial services license, your embedded finance provider is probably better placed to handle this."

When it comes to other parts of the process such as onboarding, the front-end interface, and marketing, however, things might not be so clear cut.

While there's no one-size-fits-all answer, the good news is that you don't have to go through this step alone. Your embedded finance provider can help you work out the best way forward.

"An important part of our process," explains Darren Lane, "involves sitting down with the partner and understanding what they want to do and how they'd like to do it."

"Typically, the partner will have the initial idea. Then, through the discussion, we find out what they're able and not able to do. And, more to the point, what parts of the program it makes sense for them to do."

This will often depend on your organization's size, and what resources, capabilities, and infrastructure you have in place.

"If you already have a comprehensive onboarding process, for example," continues Russell Sopp, "you might not need to use ours, because you already have the required information on file. But if your onboarding is relatively light-touch, then it's a different story."

Step 3: Pick a trusted embedded finance partner

It goes without saying, but your choice of embedded finance partner can be make or break.

So how do you pick one?

There are two key questions you should ask yourself when choosing an embedded financial services provider to work with:

- What kind of financial services license do they have?

- Do they offer an end-to-end service?

Full banking license or e-money license?

Embedded finance providers typically have a full banking license, an e-money license, or, like Solaris, both.

It's possible to issue cards with a full banking license or an e-money license.

That said, the type of card you can issue depends on the license. An e-money license enables you to offer debit cards or prepaid cards. But, if you want to offer credit cards, you'll need a full banking license.

The license will also impact your future plans.

Think you might want to offer other payment services alongside your cards, such as accounts, digital wallets, and foreign exchange? If so, an e-money license is the way to go.

With a banking license, on the other hand, you'll be able to expand into lending and investing.

It's also worth thinking about the provider's footprint.

If their license is an EU license, it will enable you to issue cards to consumers in all 27 EU member states, plus the EEA, and not just in the country where the license was issued.

Solaris also has a UK e-money license. So, alongside EU and EEA-wide coverage, working with us means you'll be able to offer financial services products to UK customers.

The benefits of an end-to-end embedded finance provider

While you may go into the project with a clear idea of which parts you will (and won't) handle, things can — and often do — change.

"There are many times when partners will come in thinking they'll take care of a particular process like, say, KYC," says Darren Lane. "And then, when they talk to us, and we explain what it entails, they'll ask us to handle it for them."

For this reason, an embedded finance provider who can offer an end-to-end service — that is, both the front-facing and back-end of the card program — can be a better option. Not only will they give you the flexibility to change your mind, but they'll also be able to address any capability gaps you uncover during the planning phase.

"At Solaris, we can help with every element of the card program," continues Russell Sopp. "That includes building the customer-facing app, marketing… we can even help with the internal business case so you can get budget approval."

Wrapping up: The wider picture

If you're an airline, hotel, or other travel provider, there are many good reasons to launch a card program.

Deeper customer relationships. Stronger brand recognition. Greater satisfaction, loyalty, and stickiness. And an additional stream of revenue to boot.

But the biggest benefit of a card program is that it's a foot in the door.

Once you're a customer's trusted payment provider, they'll likely be more open to using other products such as bank accounts and loans. And because these products give you a larger data set you can use to understand their behavior and tailor future products, they'll strengthen your relationship further, building even more loyalty and trust.